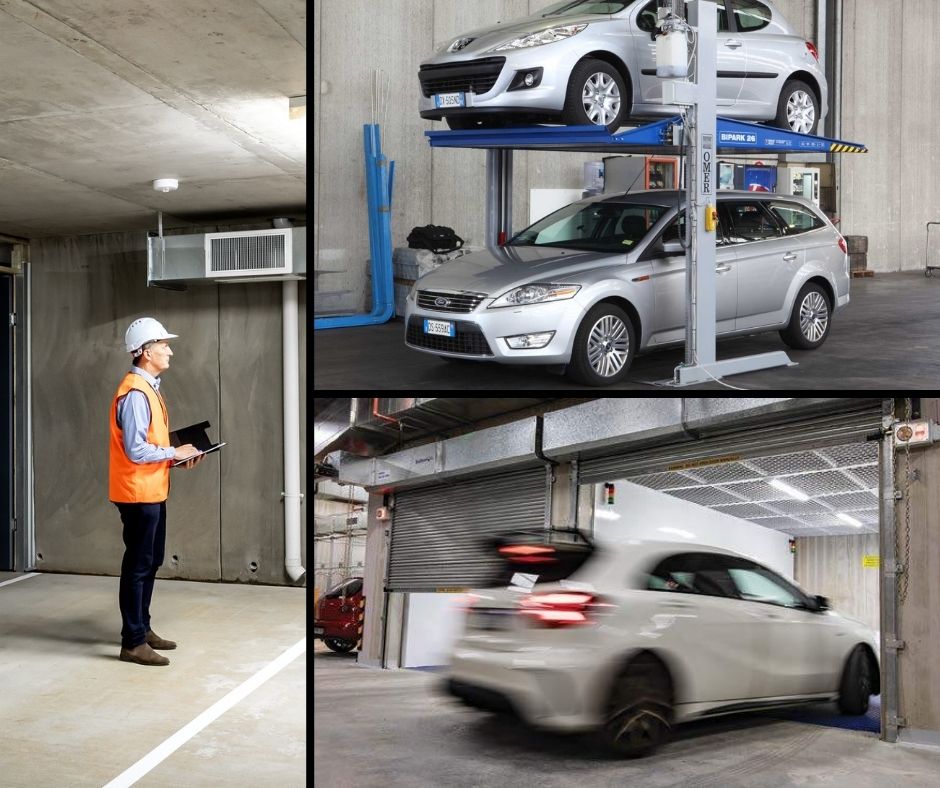

More Tax benefits for Investors with Car Stackers and Car Lifts

Did you know, you can claim depreciation on car stackers and car lifts? In many modern cities where space is a premium, the addition of car stackers or lifts to provide car parking for renters can greatly enhance the appeal of your investment property.

If you own a free-standing residential investment property and have these facilities installed, depending on the cost for these items, you could claim up to $20,000 in depreciation allowances for each space, per annum.

Alternatively, if you have purchased a property within an apartment or townhouse complex with multiple owners, you would be entitled to claim a share of the total depreciation value for the life of the items.

Car stackers and car lifts have an expected life of approximately 20 years, according to the Australian Tax Office. This means you would be eligible to claim depreciation (Division 40) on these items for up to 20 years, delivering you thousands of dollars in tax savings.

Knowing what you can and can’t claim in depreciation allowances is extremely important to ensure you don’t miss out on valuable deductions. Equally, claiming the wrong items could leave you open to penalties.

Always used qualified and experienced professionals to compile your depreciation schedules, like our Property Tax team at NBtax.

Order your comprehensive property depreciation report here.