Effective Lives of Plant & Equipment Assets Amendments

From 1 July 2019, changes to the effective lives of assets listed as Plant & Equipment Items (Division 40) will take affect impacting depreciation allowances for residential property owners. The effective life refers to the length of time an asset can be depreciated.

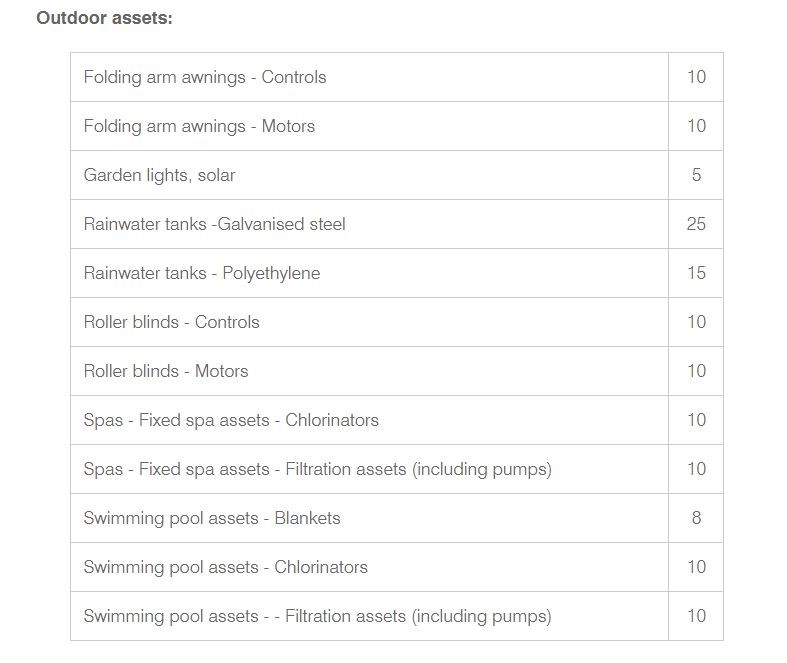

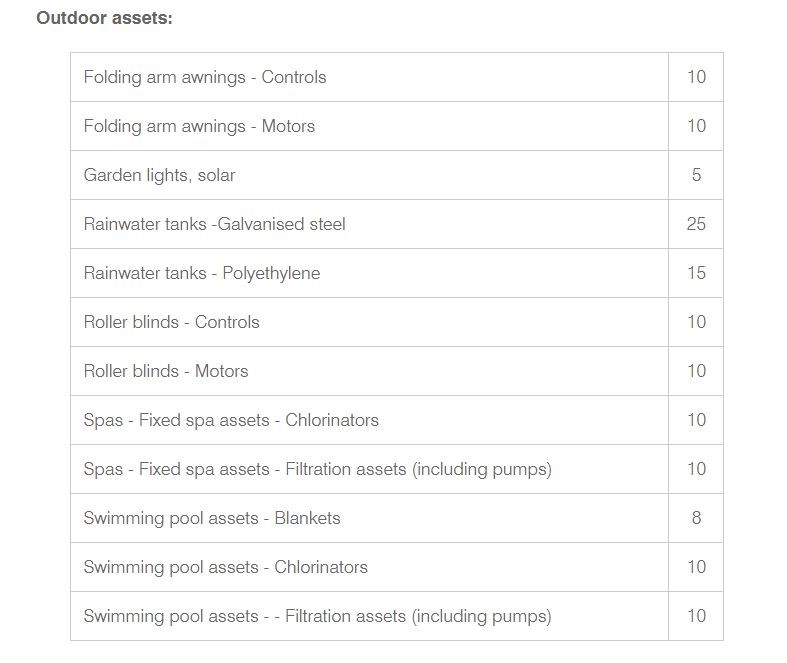

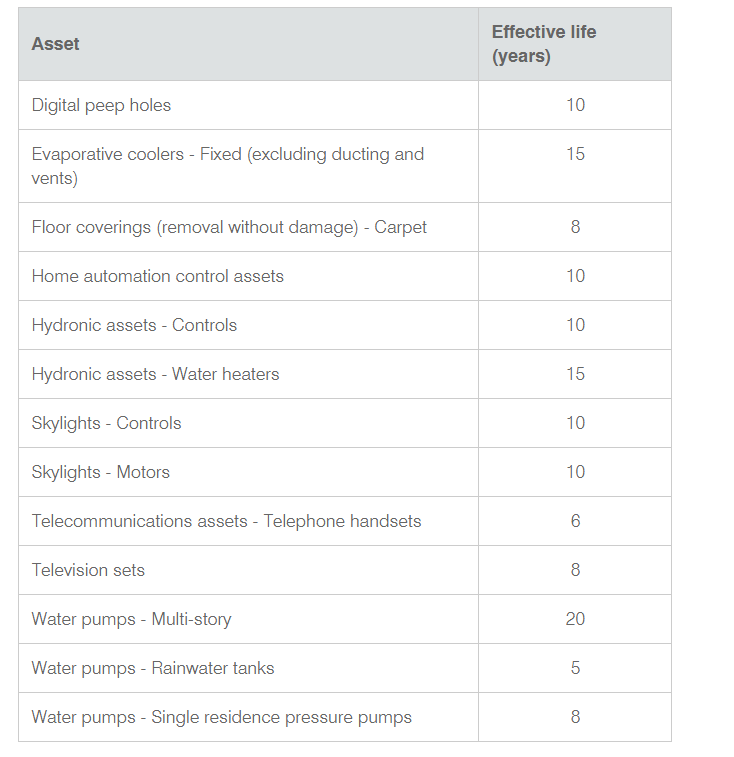

In total 32 items have been changed or added to the effective life asset list in TR 2018/4.Our assessment shows the depreciation life of 16 assets has been reduced. A further 16 new items have been added to the list and now eligible to be included as per Section 40-95 of the Income Tax Assessment Act 1997 for residential property owners (ANZSIC 67110).

Owners of existing investment properties will NOT be affected, as the legislation is grandfathered. Investors with newly constructed properties purchased after 1st July, 2019 will be subject to the new effective lives of Plant & Equipment items as determined by the above amendments.

Items affected include:

- Floor coverings, carpet – 8 years

- Home automation control assets – 10 years

- Hydronic assets,controls – 10 years and water heater – 15 years

- Skylights controls and motors - 10 years each

- Dishwasher, microwave oven - 8 years each

- Washing machine - 8 years

- Clothes dryer - 7 years

- Swimming pool assets, blankets – 8 years

- Swimming pool assets, chlorinators, filtration including pumps 10 years each

- Rainwater tanks, galvanised steel - 25 years and polyethylene - 15 years.

For the complete list refer to the tables below.

Reference source: